Foreign investment in large-scale mining has encountered serious obstacles

Over the past decade, foreign investment in large-scale mining has been hampered by the enactment of Law No. 4/2009 concerning mineral and coal, which replaced the more liberal Law No. 11/1967. The replacement act and its subsequent regulations have been the subject of intense national policy debate. Apart from a host of uncertainties due to regulatory changes, some argue that the new law substantially undermines favourable conditions for foreign mining investment. Initially, at least, the policies restricted the inflow of transnational mining capital.

Most criticism of the current development of mining investment is directed at government policy for being heavily nationalistic, for example the prohibition on exporting unprocessed ores in the 2009 law; the mandatory requirement for in-country processing and refining; and the imposition of partial but significant divestiture of foreign mining capital on domestic mining firms, both-state owned and private. Commentators commonly blame rent-seeking behaviour of government officers and politicians as the main reason for the restrictions, as it happened in the recent scandal dubbed ‘Papa Minta Saham’ (Papa Asks for Shares). Many pro-market pundits and institutions have dubbed these attempts by government to control the mining industry as ‘resource nationalism’.

While the claim of nationalism has some truth, this charge fails to consider the underlying class relations of mining that allow extraction of surplus value from the exploitation of the relatively low-paid workers by the transnational capitalist enterprises. From an imperialist perspective of class relations, this labour exploitation gives a high rate of return for transnational mining capital. This is the first feature of imperialism in this sector.

An imperial kind of capitalism

Indeed, although the large-scale mining industry provides better wages and benefits than other sectors of the economy, this does not mean that the rate of exploitation is low. Transnational mining corporations have captured significant profits from natural resources–based labour exploitation. This profitability is evident in the case of PT Vale Indonesia (PTVI), an affiliate of the Brazil-based mining giant Vale SA and subsidiary of Vale Canada. Measured by pre-tax profit over market capitalisation, its average nine-year profit rate up to 2012 was high, with official company reports showing it at about 15 per cent. In 2007 alone, in the midst of the world’s boom in nickel prices, the rate of profit reached 16.3 per cent. Furthermore, the average ten-year return on capital employed up to 2011 was around 34 per cent (with over 108 per cent for 2007).

Appropriation of surplus value resulting in substantial profit indicates a ‘super’ exploitation of labour. Considering the size of PTVI’s labour force, it is clear that the company also generated a substantial ‘super’ profit. According to its 2010 annual report ‘Working Smarter. Growing Stronger’, the average pre-tax profit per employee was listed as reaching USD185,377. Freeport McMoRan’s 2013 annual report ‘Strength in Resources’ listed its average pre-tax profit per employee as USD115,138, a figure reached because of the same condition.

The real subordination of labour to capital as a major feature of large-scale mining industries reflects these exploitative aspects. Along with other political conditions of capital–labour relations, such as the restriction of revolutionary ideals, it gives rise to the super profits made by transnational mining corporations across the archipelago.

State, sector and surplus

Not surprisingly, increasing exploitation of mineworkers has been witnessed over the last few years. While the revolutionary character of Indonesian mineworkers was suppressed as a result of the massacres in 1965 and 1966, mineworker militancy was not completely surrendered. The three-month strike by 8000 PT-FI mineworkers in 2011 and other events of labour unrest in subsequent years indicate that it is growing. Despite these events, however, the struggle remains purely economic in nature.

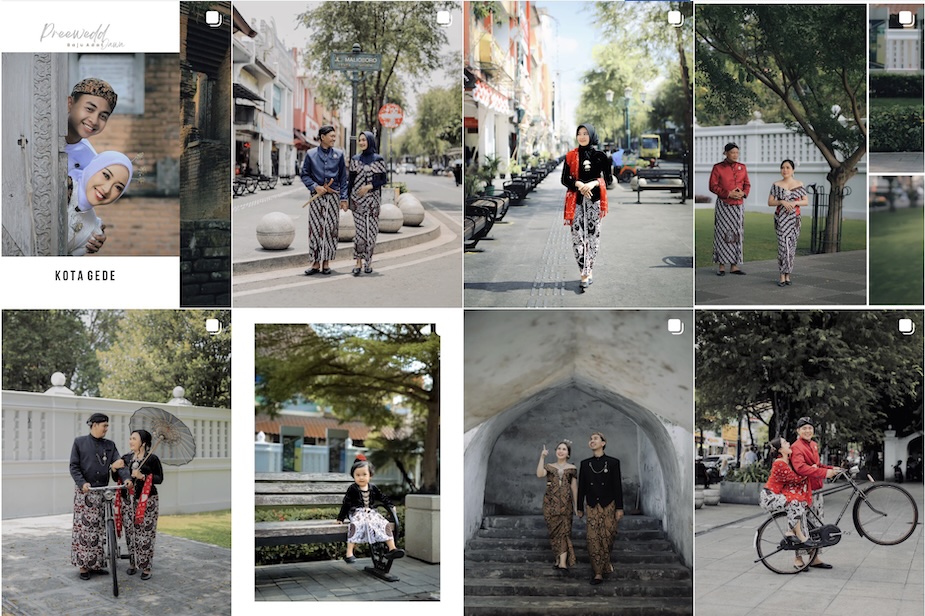

From the late 2000s onward, Indonesia and the Philippines became leading global suppliers of nickel and were blamed for the declining nickel price. (Wikimedia Commons)

Second, the high rate of return in large-scale mining investment has given rise to a struggle between the government and mining capital in appropriating the surplus. Analyses of the nationalist impulse behind the 2009 law tend to ignore this distinctive accumulation aspect, in which the state plays a vital role in imposing conditions for mineral production. In other words, the nationalistic tone of the state policy is nothing but an attempt to guarantee a fairer distribution of revenue emanating from the appropriation of surplus value. The growing demand for revenue at the national and local levels is an important factor behind the rationale of the 2009 mining law.

Since anti-capitalism has not been on the agenda for post-Sukarno policymakers, the policy has nothing to do with a struggle against the destructive effects of imperialism in this sector. Rather, the policy just reveals distribution-based competition between the state and mining capital for their individual benefits. In addition, because large-scale mining investment also involves other fractions of capital – that is, finance and commerce capitals – it necessitates the distribution of surplus value across the fractions. So from the view of capital as a whole (productive, finance and commerce), state policy that aims to garner a higher level of benefits from mineral extraction and processing is seen as affecting the high rate of return.

In the middle of this competition, the ability of the state to impose its own interest relies on objective conditions in class relations which constitute the power of the state. Under the global hierarchy of capitalism, states in the Global South like Indonesia have limited power to challenge the imperialist order. Following the logic of ‘centralisation of capital’, the most powerful fraction of transnational mining enterprises overwhelmingly emerges from the Global North. Its global expansion to the South with political support from its comprising governments obviously reflects the presence of imperialism. In this regard, the monopolistic nature of transnational mining companies can erode state sovereignty in regulating the global accumulation of capital in this sector.

Third, as competition drives capitalist development, global competition among mining capitals gives rise to national policies that protect the powerful interest of transnational mining firms. The nickel industry provides a striking example. As a result of China’s low-cost nickel pig iron production, the monopolistic powers of transnational nickel mining corporations faced serious competition. From the late 2000s onward, Indonesia along with the Philippines have become the major global suppliers of nickel ore. The Mining Business License (MBL) boom, as a result of the 2009 mining law, led to the influx of nickel ore into the Chinese market. Transnational nickel corporations such as Vale, Norilsk Nickel and Glencore-Xtrata have blamed overproduction of Indonesian nickel ore from cheap-labour MBL producers for the decline of the global nickel price. PTVI has dominated semi-processed nickel production in the archipelago by controlling significant deposits in Sulawesi for over four decades. Like other giant transnational nickel miners, PTVI’s profits also suffered as a result of global nickel overproduction.

A PTVI factory for the processing of nickel ore. Transnational mining corporations welcomed the in-country processing policy, hoping to retain dominance of global nickel production. (Wikimedia Commons)

Not surprisingly, transnational mining corporations accepted the policy on in-country processing of nickel ore. The Indonesian Mining Association (IMA), which includes PTVI among its membership, fully supported this policy. High-ranking officers of other transnational mining corporations such as the Russian-based Norilsk Nickel and the Switzerland-based Glencore-Xtrata also attendedmeetings in Jakarta with senior government officials to endorse the export ban on nickel ore. By doing so, these transnational firms sought to retain control of global nickel production by putting downward pressure on the profits of national mining enterprises who had dumped nickel ore on the Chinese market. Gaining legal protection from the Indonesian state prevented these companies from an acute decline of profit.

Response to the new policy

Significant debate has taken place within Indonesia as to whether the policy expressed in the 2009 mining law supports or undermines the interests of national miners. Because mineral processing is highly capital-intensive, most national miners opposed the policy of integrated mine and refinery projects as unfair, blaming the central government for protecting the interests of transnational mining corporations.

Smaller nickel mining companies failed because they could not raise the required capital to invest. Their defeat due to competition underlies the logic of capitalism. The majority of nickel mining projects operate in remote locations characterised by poor infrastructure, such as electricity, roads and so on. Inadequate infrastructure restricted mining companies from investing in smelting plants. While some national companies have been interested in smelter development, only a few have gone ahead with the construction of processing plants. The companies that developed smelters had to deal with foreign investors due to the nature of capital-intensive structure of the industry. This brings national nickel mining companies to be vertically integrated to the powerful fractions of China’s mining and metallurgical capitals.

To conclude, it is important to point out that the recently dubbed resource nationalism would be useless, since the law of value under capitalism determines mineral production. Under this law, the monopolistic capital i.e., transnational mining enterprises become central in mineral production. The language of resource nationalism is thus nothing but an attempt of the monopolistic capital to deal with barriers posed by of national policies. The language just serves important purposes for imperialism.

Arianto Sangadji (arianto@yorku.ca) is a PhD candidate in the Department of Geography at York University.