Indonesia's economic and political transformation has been remarkable, now the challenge is to deliver rapid, broad-based improvements in living standards

Hal Hill

First, the good news.

Viewed from the perspective of the late 1990s, the Indonesian economy has been performing better than even the most optimistic of observers would have dared to predict. At the peak of the Asian financial crisis (AFC) in 1998, the economy contracted by over 13 per cent. In economic parlance, there was a ‘peak-to-trough’ growth collapse of 20 percentage points, one of the largest in modern global economic history. There was also a large-scale exodus of capital from both the country and the currency. As a result, the rupiah was worth less than 20 per cent of its pre-AFC value relative to the US dollar, while much of the modern financial sector collapsed. The banking and corporate bailouts cost Indonesia dearly. debt, which had been modest under the Suharto administration, ballooned to about 100 per cent of gross domestic product (GDP). Poverty and unemployment rose significantly.

Unlike neighbouring Malaysia and Thailand, Indonesia experienced both an economic and a political crisis, the two of course intertwined. If recent comparative history were any guide, Indonesia then looked likely to face a prolonged period of economic stagnation. The closest parallel to the events of 1997-98 was in the Philippines, where an enduring authoritarian regime under Ferdinand Marcos collapsed in early 1986. That country’s economic decline in 1985-86 was of a similar magnitude to Indonesia’s 12 years later, and there was a major remaking of political institutions under the successor Aquino administration. It took two decades for Filipino per capita income and poverty levels to recover to those of the pre-AFC period. A reasonable presumption would have been that Indonesia would follow a similar trajectory. If anything, Indonesia’s institutional reconstruction looked to be more complex because, unlike the Philippines, its dominant domestic business group was unnerved by the anti-Chinese incidents at the time of the crisis.

Gloom about Indonesia’s economic prospects is nothing new. In fact the dominant narrative on the Indonesian economy throughout the twentieth century was a pessimistic one. There were Boeke’s dualistic theories about the non-economic behaviour of Indonesian farmers and later the proposition that an independent Indonesia would be unable to manage its economic affairs. Post independence, Benjamin Higgins, the leading foreign chronicler of the Indonesian economy in the 1950s and early 1960s, characterised the country as a ‘chronic economic dropout’. In the mid-1980s, when most developing country commodity exporters experienced a decade-long debt crisis, the Indonesian economy was similarly expected to contract. In all four cases the gloomy prognostications turned out to be wrong.

In the wake of the AFC, Indonesia again confounded the pessimists. Incomes and poverty levels took not 20 years to recover, but just seven. That is, by around 2004 these indicators were comparable to those immediately prior to the AFC. Beginning in 2000, growth returned to levels not far off those of the Suharto era. Towards the end of the decade, when another crisis threatened, this time the global financial crisis (GFC) emanating from the rich country capital markets, Indonesia weathered the challenges with ease. This is not the place to examine the reasons for the quick recovery from the AFC and the mild impact of the GFC, except to point to three key factors: the prompt and effective restoration of macro-economic stability after 1999, including a rapid reduction in public debt; broadly open trade and investment policies, albeit with significant exceptions; and general acceptance and understanding within the business community of the new institutional rules of the game.

The evolving reformasi policy compact

Yet, while the positives far outweigh the negatives, any reading of Indonesian press and social media highlights the country’s daunting challenges. Indonesia is still a poor country, with more than two-thirds of its people either below or (some times temporarily) just above an extremely modest poverty line. The country needs faster and ‘better’ growth, but a de facto political economy compact has evolved under the new democratic Indonesia that renders this goal more elusive. The compact has three main elements.

First, macroeconomic policy is essentially fenced off from political intrusion. The 2003 Fiscal Law limits budget deficits to no more than three per cent of GDP and public debt to no more than 60 per cent of GDP. This is essentially the EU’s Maastricht Accord to which, unlike the EU, Indonesia has adhered. As a consequence, providing growth exceeds three per cent and there are no major shocks (such as another bank bailout), the country’s debt relative to GDP will continue to be very modest. Monetary policy has also been depoliticised. An independent Bank Indonesia no longer funds government deficits, and it manages a floating exchange rate generally free of government interference. These two fundamentally important measures, both instituted in the wake of the bitter lessons learned from the AFC, are not well understood outside the economic community. But they have gone a long way towards making the country ‘crisis-proof’ in a conventional economic sense. The politicians and policy makers in the post-Suharto era deserve great credit for instituting and then adhering to these reforms.

Second, owing to the ever-present nationalist rhetoric, and the political imperative to fund election campaigns, Indonesia’s trade and investment policies are what Chatib Basri and I characterised as at best ‘precariously open’. Nevertheless, it is likely to remain a broadly open economy. This is principally because of the formal and informal neighbourhood effects, and at the margins, Indonesia’s commitments under the World Trade Organization. The formal regional arrangements take the form of the country’s commitments to the Association of Southeast Asian Nations (ASEAN), in December 2015 to be extended with the introduction of the ASEAN Economic Community (AEC). As part of these protocols, it is possible to erect trade barriers to the other nine member countries. But some of these economies are among the most open in the developing world. Consequently Indonesia will be under the spotlight, as it would be required to notify the group of its proposed ‘exemptions’ (from free trade within the region), which would be subject to scrutiny and possible challenges. In addition, there are the informal demonstration effects of lower trade barriers practically everywhere in developing Asia, most notably in the larger economies of China, India and Korea.

Barring unforeseen circumstances, these two positive effects will continue to drive the Indonesian economy. They are the key to explaining why the economy has performed well since 2000, even when there is seemingly so much policy disarray. If pre-reform India had its ‘Hindu Equilibrium’ growth rate of 3.5 per cent, in the absence of major shocks, Indonesia’s more or less automatic rate is at least five per cent.

But five per cent is not enough to achieve the social objective of rapid and broad-based improvements in living standards. Absolute poverty incidence (that is, the poverty ‘head count ratio’) has been declining steadily over the past decade, from about 17 per cent to 11 per cent. But, especially in recent years, the rate of decline has been appreciably slower than during the Suharto era, both because the growth rate is lower and because the growth-poverty elasticity (that is, how responsive poverty is to growth) has been declining. The main reason for the latter has been rising inequality. The (expenditure) gini ratio, for example, has risen almost 10 percentage points from 32 to 41 over the period 2003-13. The ratio ranges from 0 (perfect equality) to 100 (perfect inequality). A ratio above 40 is considered to be high. A related and major causal factor has been the much slower formal sector employment generation since 2000 (as documented by Chris Manning and colleagues), principally due to the weaker labour-intensive manufacturing growth and more restrictive labour market regulations.

The faster and better growth that Indonesia needs is being stymied by the third element of Indonesia’s post-Suharto political economy compact: the difficulty of achieving durable microeconomic reform. Without the sort of reforms referred to in the next section, it is difficult to see how the economy can grow faster. And with the bottom 40 per cent or so of the population enjoying few of the benefits of rising prosperity, Indonesia’s social and political cohesion could be jeopardised. As in Thaksin’s Thailand and elsewhere, glaring inequalities render an electorate vulnerable to the rise of populist regimes that promise much, but in reality adopt policies that further imperil socio-economic progress.

An added challenge is that it is now very likely that Indonesia will have to adjust to an era of lower commodity prices and rising global interest rates. Since around 2005 the country has enjoyed a massive transfer of wealth through historically unprecedented prices for gas, coal, palm oil and other commodities. The result has been a classic ‘Dutch Disease’ syndrome that, as in the 1970s, resulted in a sluggish non-commodity tradeables sector, especially in manufacturing. Some current research with Haryo Aswicahyono at the Centre for Strategic and International Studies has attempted to document some of the magnitudes. For example, the real exchange rate, that is the weighted nominal exchange rate adjusted for relative inflation rates, has increased, thus adversely affecting Indonesia’s competitiveness. Unit labour costs have risen significantly, especially with the recent increases in minimum wages. Productivity growth has been declining. As a consequence, most of Indonesia’s export growth since 2000 is explained by price effects, that is the commodity boom, rather than by increased competitiveness. These positive price effects are now considerably weakened. Meanwhile, Indonesia has been a relatively minor participant in the most dynamic segment of East Asian trade, the global production networks centred on electronics and the automotive industry, while it has lost export market share in one of its traditional labour-intensive mainstays, garments.

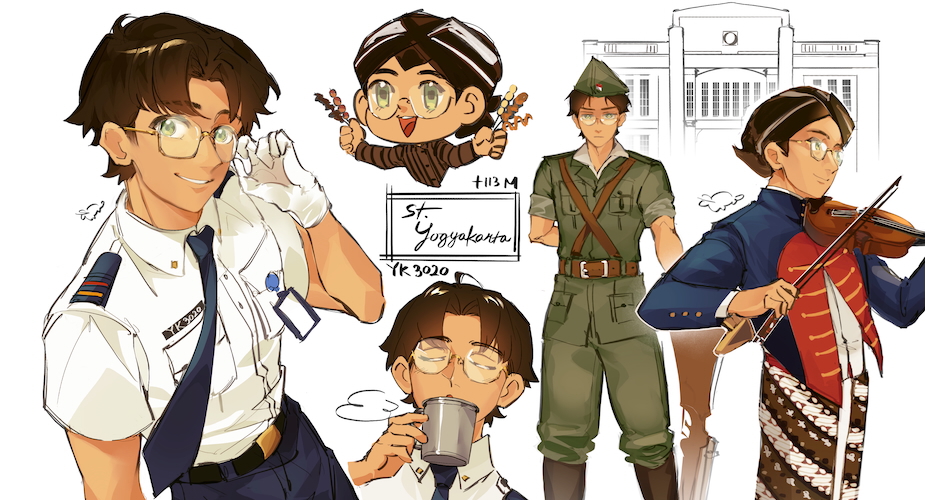

Streets - Abraham Arthemius CC

Five challenges for a new administration

So, what needs to be on the agenda of the incoming administration? Drawing on the framework above, the macroeconomic policy achievements of the past decade need to be maintained while, in Joseph Stiglitz talk, globalisation has to be effectively managed for all Indonesians, and not just for the top 40 per cent of the population. With these two building blocks, the microeconomic reform agenda needs to be aggressively addressed to achieve the pro-poor growth that Indonesia urgently needs. A non-exhaustive reform agenda includes the following, interrelated issues.

First, the fuel and other subsidies need to be phased out. At almost four per cent of GDP – coincidentally, about as costly as Thailand’s disastrous ‘rice pledge’ scheme – they dominate the government budget and squeeze out everything else. They are bad for efficiency, equity (the better off are the main beneficiaries) and the environment, the latter especially for an avowedly ‘pro-green’ administration. The subsidies highlight the fact that an incoming administration has surprisingly little fiscal space to undertake any new initiatives. The tax effort is rather weak, while on the expenditure side the subsidies, the civil service salary bill, the 20 per cent education expenditure mandate and the automatic transfers to sub-national tiers of government, Dana Alokasi Umum (General Fund Allocation) and Khusus (Special), leave little room for anything else. As in Australia, the commodity boom is vanishing but Indonesia’s fiscal policy settings have yet to make the corresponding adjustment.

Second, Indonesia is facing a severe infrastructure deficit. As a percentage of GDP, it is spending little more than half of that in the Suharto era or in Asia’s high growth economies. The result is that Indonesia lags behind its middle-income neighbours on practically every infrastructure indicator. This puts a cap on economic growth. It hurts both the rural poor, who particularly depend on rural roads and irrigation for their productivity and markets, and the urban poor, who face daunting commute times using sub-standard transport facilities. The political complexities in overcoming these problems are immense, as all four solutions to the problem will face stiff opposition. There needs to be more public funding, which has to come from lower subsidies and higher taxes. The local governments, which now have greatly increased revenue, need to be induced to spend more of their allocations on infrastructure rather than on bloated administrations and accumulated reserves. The state agencies responsible for harbours, ports and toll roads need to improve their efficiency, including, crucially, being forced to operate in a more competitive environment. There needs to be another round of deregulation, like the highly successful domestic civil aviation reforms of 2002. And populist price caps that deter international infrastructure providers need to be removed. Without these reforms, the various master plans and infrastructure summits will probably amount to little.

Third, more and better jobs need to be created. The labour market transformation that was underway from the 1980s has stalled. Formal sector manufacturing employment has been anaemic since the AFC. Thus the labour moving out of agriculture has found employment mainly in the services sector. While some of this employment has been attractive, in modern retail, finance and telecommunications, much has been in insecure, low productivity, ‘last resort’ occupations. There are both supply and demand side dimensions. The latter arises from the fact that economic growth has not been fast enough, and labour market regulations have deterred employers from hiring permanent staff. On the supply side, and in spite of impressive quantitative gains, Indonesia’s education system is under-performing. The country ranks poorly on virtually all international quality comparisons. Post-primary dropout rates for the poor are very high. No Indonesian university ranks in the Asia top 100 league. (The government in fact spends ten times as much on subsidies as it does on higher education.) It is not surprising that international investor surveys for Indonesia highlight labour problems as a serious bottleneck. Two-thirds of employers report skills shortages, while youth unemployment is about double the national average. Over time, the Indonesian labour market may come to resemble that of the Philippines, where the most dynamic segment is international employment.

Fourth, there is an increasing disconnect between the fluid, open political system and the vibrant civil society on the one hand and the largely unreformed civil service on the other. Indonesia continues to rank poorly on comparative business surveys, including ease of start-ups, property rights and protection, international trade logistics, labour regulations, general licensing provisions, and of course corruption perception indicators. To be sure, there have been some notable improvements since the Suharto era. The country now has a vigorous, independent anti-corruption commission, the KPK. The central bank, Bank Indonesia, has become more professional and independent. Regional autonomy opens up the possibility – though arguably not yet the reality – of broad-based improvements in local level governance, and with it of better-governed regions being rewarded with a reform dividend of more investment and employment. But without a more professional civil service, responsive to the community’s needs, based on meritocratic principles, and with incentives that underpin these objectives, bureaucratic quality will continue to be a drag on economic development and civil society.

Finally, policies need to be much more actively pro-poor, without sacrificing economic growth. Indonesia’s rising inequality jeopardises the country’s social cohesion and renders it more vulnerable to dangerous populist rhetoric. At least four sets of measures are required. First, the tax-transfer system needs to be pro-poor. Currently the effects of government policies are practically distribution-neutral. That is, there is little if any progressivity in tax policy, while education and health policies are generally not well targeted on a needs basis. Second, as noted, the labour market needs to become more inclusive, so that more decent jobs are created. Third, particular attention needs to be paid to education quality at all levels and for all socio-economic classes, so that not only is the average quality raised but also the inequities in the current outcomes are ameliorated. The 20 per cent budget mandate for the first time removes finance as the binding constraint. Finally the very modest social safety net programs need to be extended so that they provide genuinely effective insurance against sudden and catastrophic declines in living standards, as well as making inroads into ‘hard-core’ poverty, which is particularly concentrated among female-headed households and in lagging regions. In comparative terms, Indonesia’s social spending, at about five per cent of GDP is modest. Excluding education, it is minimal. Here too, removal of the subsidies is a key part of any reform.

Scenarios

Consistent with the style of modern, personalistic electoral politics everywhere, none of these issues featured in Indonesia’s 2014 parliamentary and presidential campaigns, beyond impassioned nationalist rhetoric and vague sloganeering. Based on their histories and campaigns, can one draw any inferences about the two candidates and their policy priorities for the next five years?

First, Joko Widodo: he appears more likely to address the subsidies issue, although it is not clear how far he would progress, and how the released funds would be used. His campaign rhetoric has been somewhat less xenophobic. He has demonstrated governance capacity, albeit at a municipal rather than a national level. He appears to be completely free of any allegations of misconduct and corruption. He has also had to make fewer personal and policy concessions to obtain endorsement and construct a coalition. To this extent he may be less constrained in his policy choices.

Next, Prabowo Subianto: we have practically no prior indication of his likely policy directions since he has never held an administrative position outside the armed forces. If anything, his policy pronouncements are even more vague that those of Widodo. His father was in effect the founder of the Indonesian economics profession, but this connection does not seem to have had inter-generational effects. Perhaps it could be said that he has a greater appreciation of international business issues by dint of his family and others in his immediate circle. He also has a reputation for decisiveness.

Under Indonesia’s political rules, the president appoints the cabinet members. During the democratic era, there has been a welcome trend towards the appointment of ‘professionals’ to some key government departments. By far the most important for economic policy is the Minister of Finance. The Governor of Bank Indonesia is another crucial appointment. We have little guidance thus far about the likely cabinet appointments, although Widodo has signaled an intention to appoint a substantial number of professionals. It would not be unfair to state that neither side has highly credentialed economic advisors, although within the Prabowo camp there is his brother-in-law, the highly regarded former Bank Indonesia governor, Dr J. Soedradjad Djiwandono.

In the Suharto era, the late Hadi Soesastro provided the analytical framework for understanding the success of economic policy reforms. The key ingredients were the threat of economic crises, or at least slow economic growth; the united team of technocrats having a coherent and feasible set of reform measures and a direct channel of communication, via ‘low politics’ (that is, avoiding grand ideological debates), to an all-powerful President Suharto who, once convinced of the need for change, was able to implement the reforms comprehensively and decisively.

Assuming that Indonesia does not experience a serious economic crisis, none of these ingredients is currently present. Neither of the candidates has displayed an inclination to become a ‘reform champion’ in a way that would significantly lift the country’s economic momentum. In the short run, the best that can be hoped for is that enough of the policy setting adumbrated above will be maintained to ensure that at least five per cent growth is achieved. The task for the professional economics community will then be an educative one, to undertake the high-quality analytical work that outlines the case for reform, to lift the quality of public debate and thus for the community to put pressure on the legislature and the bureaucracy to enact and implement better policies.

Such is the complexity of managing the modern democratic Indonesia that simply maintaining the status quo is not an inconsiderable achievement. But on the basis of the evolving political economy, and the presidential candidates and their platforms, the prospects of rapid economic development are not encouraging. Nevertheless, as pointed out earlier, Indonesia has consistently confounded the pessimists, and perhaps is about to do so again.

Hal Hill is the H.W. Arndt Professor of Southeast Asian Economies at the Australian National University.