Why are the New Order billionaires still doing so well?

Christian Chua

The young IT specialist working for a multinational company in Jakarta has plenty to pride herself on. Her monthly pay packet of US$2,000 is bigger than that of 99 per cent of her fellow Indonesians. A first class international education, an excellent command of English and long office hours – she has worked hard to achieve her position. But how hard must one work to accumulate US$1 billion? Hardly possible, one might think. Yet, there are a few Indonesians whose fortunes outreach that amount. Twenty-one persons – up from twelve the year before – are on the 2010 Forbes Asia Indonesian billionaires list. And many of them are familiar faces from the rankings of conglomerates in the mid-1990s, during the final years of the Suharto era.

Hard work might be fundamental to draw an income of US$2,000. But it cannot explain the extraordinary wealth of a billionaire in Indonesia. So what can? One convenient answer lies in the dominant ethnicity of Indonesia’s capital class. Indeed, of today’s 21 billionaires at least half are ‘Chinese’, though the label is imprecise and controversial. How did Chinese come to dominate the very apex of the economy in Indonesia? And why have they been able to hang onto and perhaps even strengthen their position in post-authoritarian Indonesia?

Racial clichés

One common explanation is that Indonesia’s Chinese are so successful because of their legendary ‘Chinese’ business acumen. They are supposed to be intelligent, diligent, competitive, and so forth. For a long time, economic backwardness in China itself contradicted this explanation, but that no longer holds, to the relief of those who believe in it. This ethnic approach is pervasive especially in the business world itself. But a closer look at history will cast doubt on these racial clichés. Ethnic traits are always socially constructed, and this is especially true of the so-called ‘Chinese Indonesians’ whose ancestors came to Indonesia generations ago.

Before the eighteenth century, traders migrating from southern China to Southeast Asia integrated smoothly into local societies. This changed with the arrival of the Europeans. The colonialists needed middlemen who could mediate with people they regarded as indigenous. Who was more appropriate for this role than the settlers from China? They had already established extensive trading networks across the islands and into the interior. Moreover, they could be easily defined as ‘foreign orientals’ and thus separated from the people who, in theory, owned a claim to the land they were living on.

At least half of Indonesia’s billionaires are ‘Chinese’

Thus some Chinese businesspeople became compliant collaborators with the colonial Dutch. Accordingly, after the end of colonial rule, there was no political space for the Chinese minority in the new nation of Indonesia founded in 1945. But when General Suharto took over power in 1965, he revived many colonial principles. His New Order regime implemented a whole range of policies meant to marginalise and discriminate against Indonesians of Chinese origin, and indeed to stigmatise the whole ethnic minority as rich. Yet at the same time the New Order coopted selected ethnic Chinese families as exclusive business partners for its political elite.

There was a clear rationale for this double-sided approach. These businesspeople, even though they had nothing in common with the small Chinese shopkeeper or pharmacist, were seen to belong to the same ostracised ethnic group. They became the perfect partners for the new rulers: obedient, grateful, loyal, and quiet.

This constellation hardly changed over the decades. Big business became synonymous with large Chinese corporations. In the 1990s, 26 of the 30 biggest conglomerates in Indonesia were owned by Suharto’s Chinese cronies. None of them did anything to soften their marginalised status; the ties were too profitable. Fear also played a role. Anti-Chinese riots were regularly instigated, and officials issued statements against the conglomerates. Although neither the riots nor the admonitions had practical consequences for the very richest Chinese entrepreneurs, these events kept them on a short leash. Power and money, usually a close combination, were thus effectively separated.

Crisis

The conglomerates were a specific formation of the New Order. Most people reckoned they could only survive in an alliance with those who had brought them into being. When the 1997 financial crisis ended the Suharto regime, not just expert observers but even the tycoons themselves believed this would also mean the end of Chinese big business.

But it did not. More than a decade later, most of the businessmen successful under Suharto are still around. Indeed they are thriving, as the latest Forbes list demonstrates. How can this success be explained? Does it mean that 1998 really brought no change? Or did they become ‘real’ capitalists, who could sustain themselves without political protection? The answer lies somewhere in between.

Immediately after the fall of Suharto the Chinese conglomerates did indeed tumble. Their licence to print money was revoked, as the banks that they founded to fund the enormous expansions of their business activities went bankrupt. Other concessions they had obtained over the years – even for ventures typically in the hands of the state such as infrastructure projects – were taken away from them. Monopolies were annulled. Undertakings requiring enormous patronage were no longer possible in this more democratic, decentralised, and deregulated environment. It was the market that was expected to rule, and not a tiny clique of generals with their Chinese clients.

More than a decade on, most of the businessmen who were successful under Suharto are still thriving

Many tycoons did indeed re-align their businesses as a result of the increased scrutiny by regulatory boards, public interest watchdogs, the media, and some reform-minded politicians. For instance, Mochtar Riady, founder of the Lippo Group, became a point of attack for the newly articulate and assertive public. Riady symbolised for them the murky practices of the old system. It took massive financial engineering and some effective lobbying with regulators and politicians for him and his son James to prevent the loss of their conglomerate. Today however, the Riady family remains among the 30 richest in Indonesia, with a net worth of US$730 million.

Or take Anthony Salim, who heads the Salim Group of business ventures, founded by his father Liem Sioe Liong, President Suharto’s closest crony. His conglomerate used to include BCA (Bank Central Asia), the biggest private bank in Southeast Asia. After Suharto was deposed in 1998, Salim was accused of corruption, taken to court, and had to settle enormous debts. He lost the BCA, and the whole group was about to break apart. At the time, no one would have placed even a small bet on its survival. However, Anthony Salim is today fifth on the Forbes list, with a net worth of US$3 billion. This does not exactly correspond with the common definition of ‘crash’. It looks like a remarkable survival.

Continuity

Together with Mochtar Riady and Anthony Salim, no less than 12 other owners of conglomerates listed in the last top 30 ranking before the 1997-98 financial crisis have made it into the current top 30. This is significant continuity. Within Indonesia, the previous transition, from Suharto’s predecessor Sukarno to the New Order, produced a more substantial reconfiguration of the business class.

The present continuity points to three characteristics of post-authoritarian Indonesia. First, the political regime in reality only underwent minimal, superficial change. The underlying structures were not dismantled. The new regime needed quick economic recovery. Chinese Indonesian businesses were its indispensable pillar. Rapid reconstruction of the economy without their capital was no option.

Second, old political forces proved to be rather resilient. Personnel continuities in the legislative, executive, and judiciary branches of government allowed corrupt practices to continue. The conglomerates had had many years of experience here. They were experts.

Capital

But third, a slow yet steady turn to a more market-based economy is definitely taking place. This helped the Chinese capitalists emancipate themselves from their former patrons, making them less dependent on political patronage. In post-crisis Indonesia, their capital alone provides plenty of protection, especially since their ethnicity cannot be used as a justification to shackle them any longer.

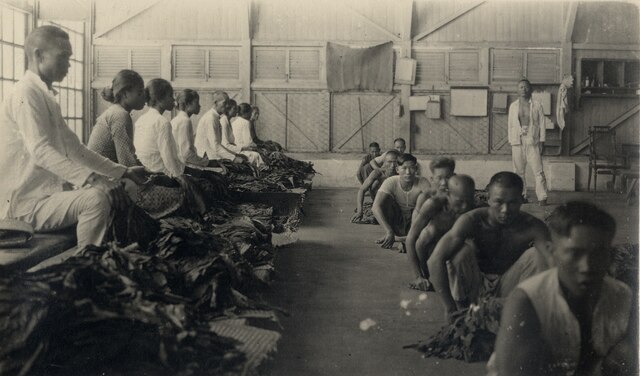

So in the end, as the country gradually leaves behind its authoritarian, centralised, protectionist past and moves towards a democratic, decentralised, deregulated future, the old conglomerates are well prepared to flourish under any regime that might come. After a few worrying years, today they feel on top of the world. A glance at the business sectors in which the billionaires make their money speaks volumes: palm oil, coal, and tobacco. In other countries, many corporations steer clear of these activities, because they are so contentious. The political lobbying they require is just too difficult. But in today’s Indonesia there seem to be few limits for capital. For those who had a good start under the New Order, the accumulation of extraordinary wealth is easier than ever.

Christian Chua (christian.chua@gmail.com) works for Deutsche Bank and lectures at the University of Frankfurt. He is the author of Chinese Big Business in Indonesia: The State of Capital (Routledge, 2008).